19 Sep Antifragile

The opposite of fragile is not robust/resilient. Robustness or resiliency is merely a neutral variant of fragility. “Antifragile” is the concept that something strives in the presence of uncertainty.

Overcompensation happens in many areas where the “system” overcompensates to deal with the possibility of occurrence of the same event with bigger magnitude. The examples of vaccination and muscle building make this concept very clear.

The issue of over-parenting and over protection of our kids is particularly relevant to me as I start to observe and develop my own parenting style. Kids need to have a certain amount of uncertainty for them to learn to deal with life.

Mechanical objects tend to be robust but fragile while biological objects tend to be self healing and anti fragile. Societies, economies and culture tends to resemble biological objects.

Having a single employer is stable but fragile (think retrenchment in your 50s) while having many employers is less stable but antifragile (think having many customers as a cab driver).

Just as a little bit of fire here and there gets rid of the flammable material in a forest, a little bit of harm here and there in an economy weeds out the vulnerable firms early enough to allow them to “fail early” (so they can start again) and minimize the long term damage to the system.

Experiments show that alertness is weakened when one relinquishes control to the system (again, lack of overcompensation).

Few understand that procrastination is our natural defense, letting things take care of themselves and exercise their antifragility; it results from some ecological or naturalistic wisdom, and is not always bad – at an existential level, it is my body rebelling against its entrapment. It is my soul fighting the Procrustean bed of modernity.

One analogy to economics: after the inception of the financial crisis in 2007-2008, many people thought that predicting the subprime meltdown (which seemed in their mind to have triggered it) would have helped. It would not have since it was a symptom of the crisis, not its underlying cause.

After the occurrence of an event, we need to switch the blame from the inability to see an event coming (say a tsunami, a war, or a financial crisis) to the failure to understand antifragility, namely, “why did we build something so fragile to these types of events?” Not seeing a tsunami or an economic event coming is excusable; build something fragile to them is not.

Antifragility implies more to gain than to lose, equals more upside than downside, equals favourable asymmetry.

If you put 90% of your funds in boring cash (assuming you are protected from inflation) and 10% in very risky, maximally risky, securities, you cannot possibly lose more than 10%, while you are exposed to massive upside. Someone with 100% in so called ‘medium’ risk securities has a risk of total ruin from the miscomputation of risks. This barbell technique remedies the problem that risks of rare events are incomputable and fragile to estimation error; here the financial barbell has a maximum known loss.

After the occurrence of an event, we need to switch the blame from the inability to see an event coming (say a tsunami, a war, or a financial crisis) to the failure to understand antifragility, namely, “why did we build something so fragile to these types of events?” Not seeing a tsunami or an economic event coming is excusable; build something fragile to them is not.

Antifragility equals more to gain than to lose equals more upside than downside equals asymmetry (unfavorable) equals likes volatility. And if you make more when you are right than when you are hurt when you are wrong, then you will benefit, in the long run, from volatility (and the reverse). You are only harmed if you repeatedly pay too much for the option.

Financial independence, when used intelligently, can make you robust; it gives you options and allows you to make the right choices. Freedom is the ultimate option.

No one at present dares to state the obvious: growth in society may not come from raising the average the Asian way, but from increasing the number of people in the “tails,” that small, very small number of risk takers crazy enough to have ideas of their own, those endowed with that very rare ability called imagination, that rarer quality called courage, and who make things happen.

The story of the wheel also illustrate the point of this chapter: both governments and universities have done very, very little for innovation and discovery, precisely because, in addition to their blinding rationalism, they look for the complicated, the lurid, the newsworthy, the narrated, the scientistic, and the grandiose, rarely for the wheel on the suitcase. Simplicity, I realized, does not lead to laurels.

Random tinkering (antifragile) => Heuristics (technology) => Practice and Apprenticeship => Random tinkering (antifragile) => Heuristics (technology) => Practice and Apprenticeship …

At first I thought that economic theories were not necessary to understand short term movements in exchange rates, but it turned out that the same limitation applied to long term movements as well. Many economists toying with foreign exchange have used the notion of “purchasing power parity” to try to predict exchange rates on the basis that in the long run “equilibrium” prices cannot diverge too much and currency rates need to adjust so a pound of ham will eventually need to carry a similar price in London and Newark, New Jersey. Put under scrutiny, there seems to be no operational validity to this theory – currencies that get expensive tend to get even more expensive, and most Fat Tonys in fact made fortunes following the inverse rule. But theoreticians would tell you that “in the long run” it should work. Which long run? It is impossible to make a decision based on such a theory, yet they still teach it to students, because being academics, lacking heuristics, and needing something complicated, they never found anything better to teach.

People with too much smoke and complicated tricks and methods in their brains start missing elementary, very elementary things. Persons in the real world can’t afford to miss these things; otherwise they crash the plane. Unlike researchers, they were selected for survival, not complications. So I saw the less is more in action: the more studies, the less obvious elementary but fundamental things become; activity, on the other hand, strips things to their simplest possible model.

When you are fragile you need to know a lot more than when you are antifragile. Conversely, when you think you know more than you do, you are fragile (to error).

Overconfidence leads to reliance on forecasts, which causes borrowing, then to the fragility of leverage. Further, there is convincing evidence that a PhD in economics or finance causes people to build vastly more fragile portfolios. George Martin and I listed all the major financial economists who were involved with funds, calculated the blowups by funds, and observed a far higher proportional incidence of such blowups on the part of finance professors – the most famous one being Long Term Capital Management, which employed Fragilistas Robert Merton, Myron Scholes, Chi-Fu Huang, and others.

I was rather a barbell autodidact as I studied the exact minimum necessary to pass any exam, overshooting accidentally once in a while, and only getting into trouble a few times by undershooting. But I read voraciously, wholesale, initially in the humanities, later in mathematics and science, and now in history – outside a curriculum, away from the gym machine so to speak. I figured out that whatever I selected myself I could read with more depth and more breadth – there was a match to my curiosity.

It was a barbell – play it safe at school and read on your own, have zero expectations from school.

To this day I still have the instinct that the treasure, what one needs to know for a profession, is necessarily what lies outside the corpus, as far away from the center as possible. But there is something central in following one’s own direction in the selection of readings: what I was given to study in school I have forgotten; what I decided to read on my own, I still remember.

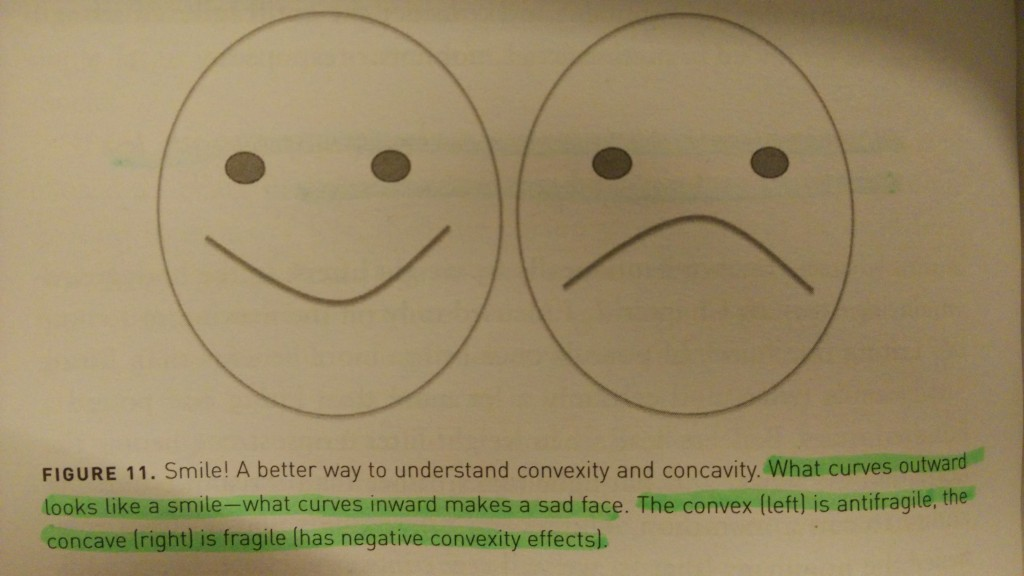

Fragility was simply vulnerability to the volatility of the things that affect it. For the fragile, the cumulative effect of small shocks is smaller than the single effect of an equivalent single large shock. For the antifragile, shocks bring more benefits (equivalently, less harm) as their intensity increases (up to a point).

Just as there is a dichotomy in law: innocent until proven guilty as opposed to guilty until proven innocent, let me express my rule as follows: what Mother Nature does is rigorous until proven otherwise; what humans and science do is flawed until proven otherwise.

Professors are not penalized when they teach something that blows up financial system, which perpetuates a fraud. Departments need to teach something so students get jobs, even if they are teaching snake oil – this got us trapped in a circular system in which everyone knows that the material is wrong but nobody is free enough or has enough courage to do anything about it.

Everything gains or loses from volatility. Fragility is what loses from volatility and uncertainty. The glass on the table is short volatility.

Look around you, at your life, at objects, at relationships, at entities. You may replace volatility with other members of the disorder cluster here and there for clarity, but it is not even necessary – when formally expressed, it is all the same symbol. Time is volatility. Education, in the sense of the formation of character, personality, and acquisition of true knowledge, likes disorder. Some things break because of error, others don’t. Some theories fall apart, not others. Innovation is precisely something that gains from uncertainty: and some people sit around waiting for uncertainty and using it as raw material, just like our ancestral hunters.

No Comments