Fixed Size

Fix the number of lots.

Maximum Drawdown

Have enough equity to withstand the worst case maximum drawdown.

Take 150% of the worst case drawdown plus the margin for the first lot. Each subsequent lot is added when the equity increase by 150% of the worst case drawdown.

Fixed % Size

Risk the same percentage on each trade.

Fixed Ratio

Key parameter is Delta, the dollar amount of profit per traded unit to increase the number of units by one.

Base to calculate the number of traded lots is

N = 0.5 * [((2 * No – 1)2 + 8 * P/delta)0.5 + 1]

where N is traded position size, No is starting position size, P is total closed profit, Delta is as above.

Optimal F

Fixed fractional trading, introduced by Ralph Vince, based on formula derived from Kelly method.

Kelly Formula

Kelly% = (win% – loss%)/(average profit/average loss)

Due to limited sample size and large variance, the numbers used in this formula will introduce a significant degree of variance in the results of the Kelly formula. It is this very fuzziness that introduces a level of inaccuracy in the use of formulae such as Kelly or Optimal F.

Safe f

We want max safe position size with regards to risk tolerance. Too high a position size and drawdown is likely to exceed tolerance, too low a position size and we voluntarily sacrifice profits.

The Only Knob to turn to achieve the optimal risk level is Position Size. Lowering position size lowers drawdown. Fractional position sizing is near-optimal and easily implemented.

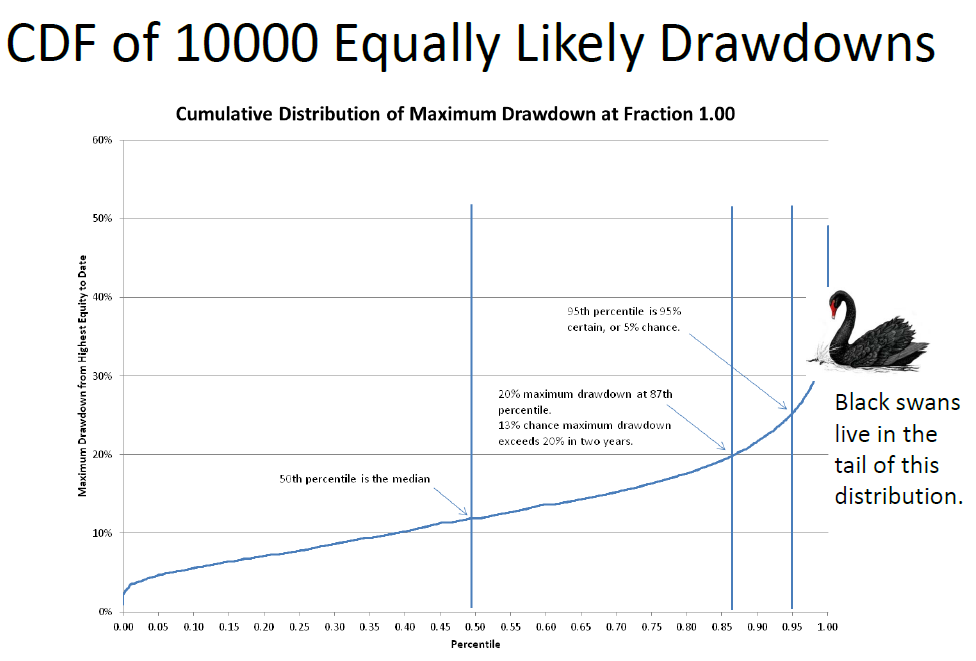

For the test so far, all trades were taken with all funds. Position size = 1.00 which means full fraction. Position size is not stationary, but for now assume one position size works equally well over the entire time period.

What fraction is safe?

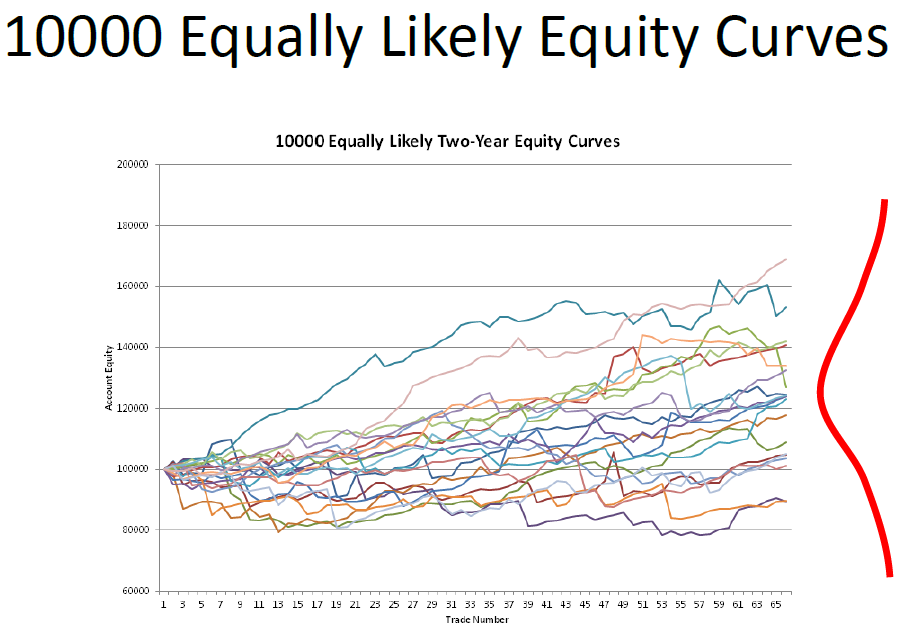

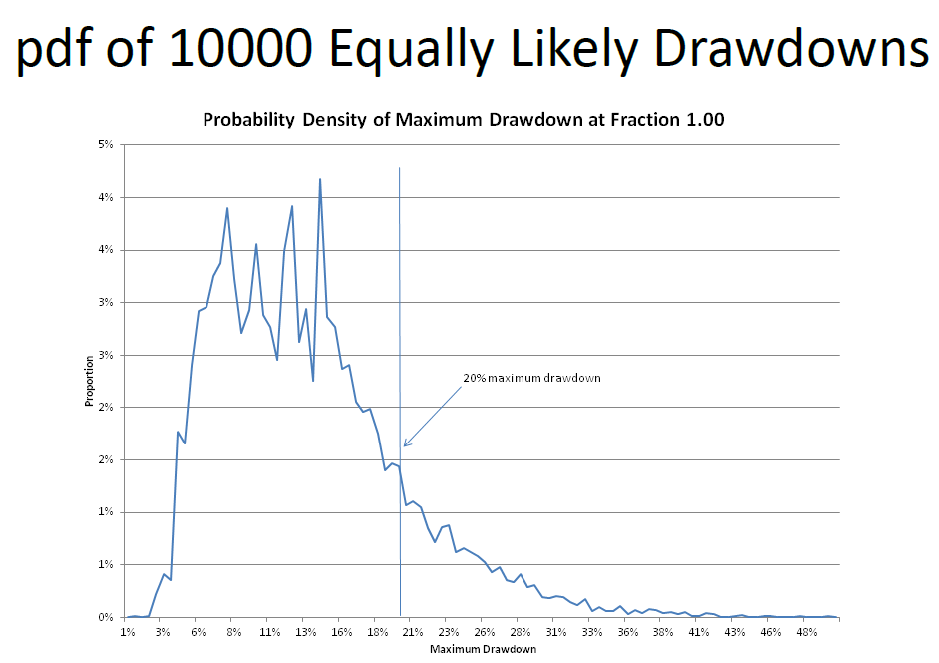

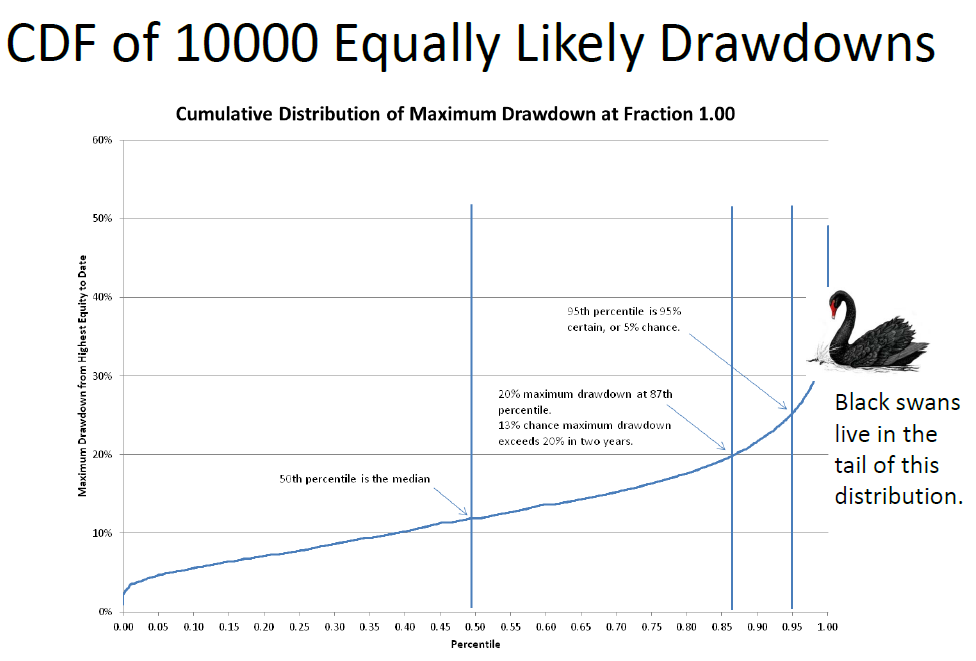

Using Monte Carlo of 2 years, we do not know which patterns will occur in which order over the next two years. The set of 423 trades from the development tests we are analyzing is our “best estimate.” It covers 13 years. At random, pick enough trades from the 423 to cover 2 years – 65 trades. The position size that lowers drawdown to the point you feel the system is safe to trade is safe-f.

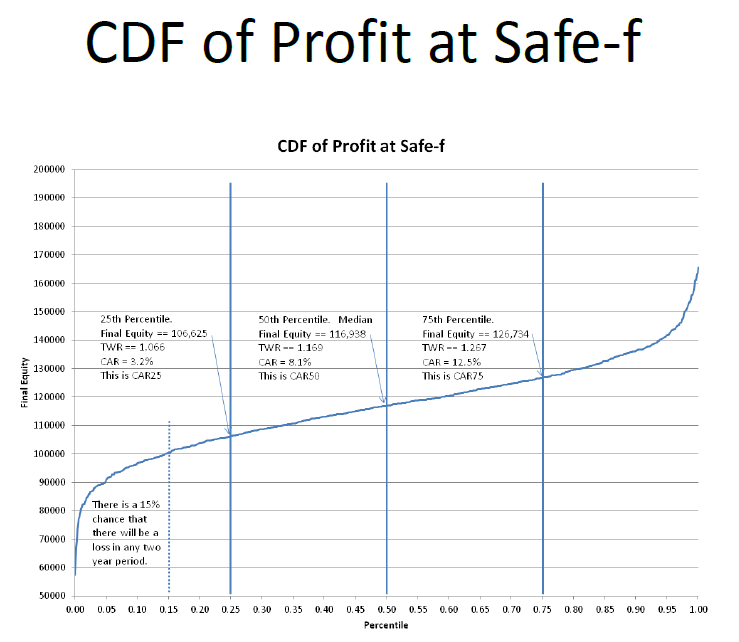

Profit is a function of position size. You want the highest position size fraction you can tolerate. We want to limit drawdown in the balance of the entire trading account.

If safe-f is less than 1.00, some funds will be left in cash as ballast. They cannot be used for any other purpose. The drawdown of the combined traded plus ballast is 20%.

- Drawdown of ballast is 0%.

- Drawdown of traded funds is approximately 20% / safe-f.

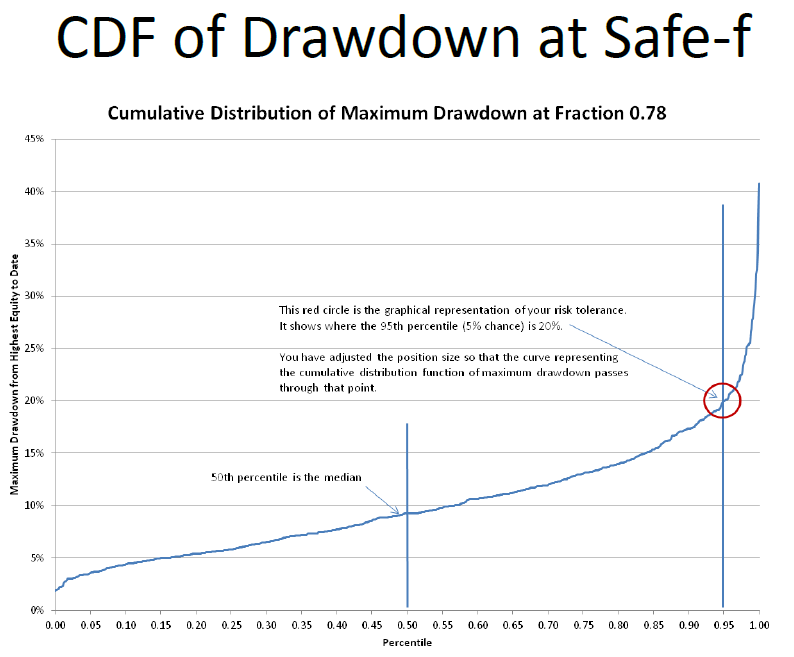

- Adjust Position Size

- Rerun the Monte Carlo simulation using different values for the fraction.

- Search for the highest fraction where maximum drawdown is 20% at the 95th percentile.

- For this system, that fraction, safe-f, is 0.78.